Everything You’ve Been Told About Investing Is Wrong: Here’s the Real Truth

Investing can feel overwhelming, especially with all the advice you’ve heard over the years. You may have been told to play it safe, stick to certain types of investments, or always follow the crowd.

But what if I told you that much of what you think you know about investing could be fundamentally wrong? The world of investing is changing rapidly, and the old rules don’t always apply anymore. Let’s break down some common misconceptions and reveal the real truths that can help you make better investment decisions.

The Myth of Diversification

You’ve likely heard that “diversification is key” when it comes to investing. While spreading your investments across different assets can help reduce risk, it can also limit your potential for high returns. In today’s market, focusing on a few high-potential investments can sometimes yield better results than trying to cover too many bases. Instead of diversifying just for the sake of it, think critically about where to put your money for the best chance of growth.

The Truth About Blue-Chip Stocks

Blue-chip stocks—those well-established companies with a history of stability—have been considered safe investments for a long time. However, sticking only to these stocks might prevent you from exploring newer companies that could offer bigger returns. Many exciting innovations are coming from younger, smaller companies, especially in technology and sustainability sectors. It’s important to balance your portfolio and consider these growth opportunities alongside traditional blue-chip investments.

Rethinking Bonds

Bonds have long been viewed as a safe investment option. However, with rising interest rates and inflation, the value of bonds can decline. This means that while they might provide steady income, they can also lead to losses if the market shifts. Instead of relying heavily on bonds, it’s essential to evaluate how they fit into your overall investment strategy. Consider alternative options like real estate or stocks that can offer better returns in today’s economy.

Embrace a New Mindset

If traditional investing advice feels outdated, it’s time to adopt a fresh perspective. Here are some tips to help you navigate the current investment landscape:

Think Like an Entrepreneur: Instead of just being an investor, see yourself as an entrepreneur. Look for opportunities in emerging industries or innovative startups. Your passion and understanding of these areas can lead to informed and profitable investment choices.

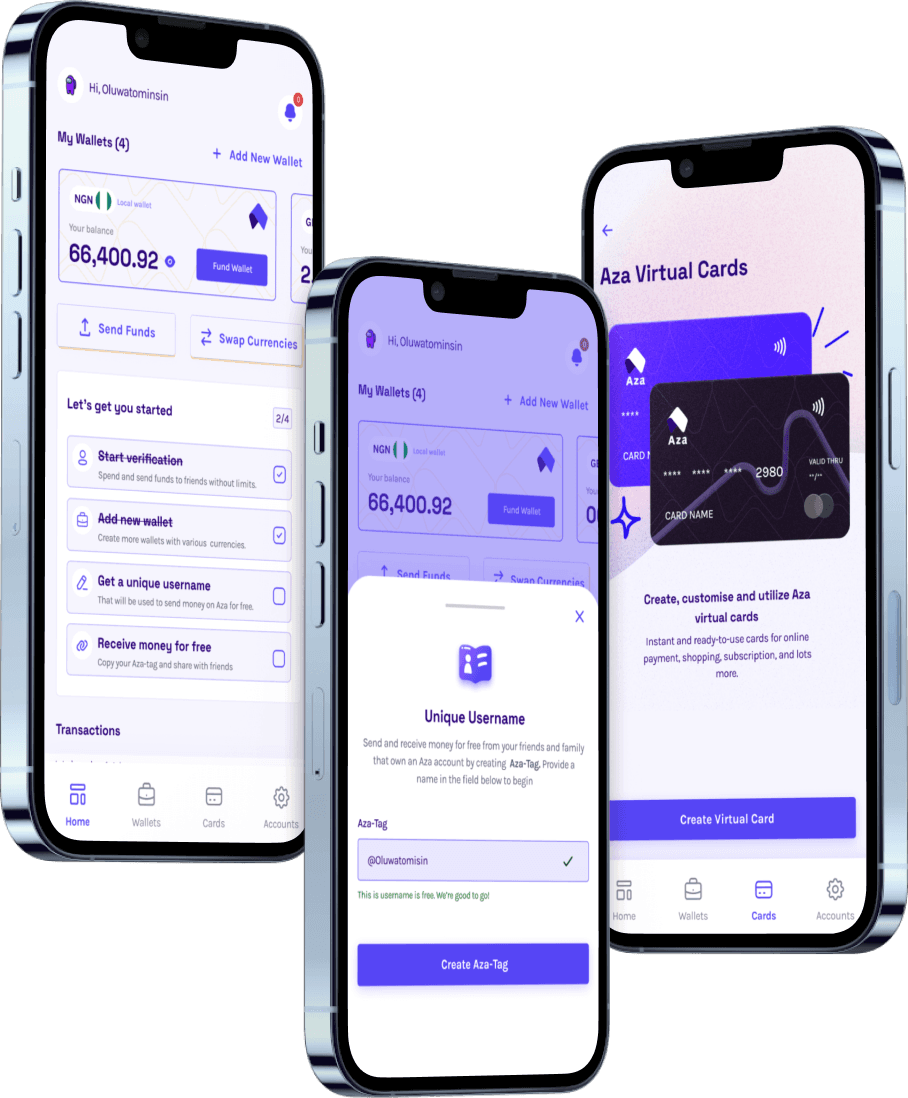

Use Technology to Your Advantage: The digital world offers a wealth of tools and data that can enhance your investing strategy. Use apps and platforms that provide market insights, track your investments, and help you make informed decisions.

Stay Flexible: While long-term investing is generally a good strategy, being flexible is crucial. Markets can change rapidly, and your investment strategy should adapt accordingly. Regularly review your portfolio and be willing to pivot when necessary.

Invest in What You Understand: It’s easier to make informed decisions when you invest in industries or sectors you’re passionate about. Focus on areas where you have knowledge or interest, as this can help you identify promising opportunities.

Adopt a Growth Mindset: Stay curious and open to learning. Attend workshops, read investment books, and connect with other investors. Engaging with new ideas and strategies can help you refine your approach and discover new investment opportunities.

Conclusion: Rethink Your Approach to Investing

Investing doesn’t have to be complicated, and it shouldn’t be limited by outdated beliefs. Through challenging traditional investment wisdom and embracing a new mindset, you can uncover opportunities that align with your goals and risk tolerance.

Remember, the best investors are those who adapt to change and seek out new paths to success. It’s time to take control of your investment journey and make choices that work for you. Whether you’re new to investing or looking to refresh your strategy, embracing these insights can help you build a more robust and rewarding investment portfolio.

Are you ready to rethink your investment approach and explore the possibilities that await? The journey to becoming a savvy investor starts now!