How Parents Can Easily Send Money to Their Children Abroad (Without the Bank Stress)

Raising kids is already a full-time job. Add “sending money overseas” to the list, and it starts to feel like another career entirely.

You’ve probably heard the stories. Parents queuing at banks for hours just to push one transfer through. Money routed through family friends or uncles who somehow take their own share before it ever reaches your child. School fees delayed for weeks because international banking has its own timetable. Extra charges showing up on statements with no explanation.

One dad told me recently he spent almost two weeks trying to get school fees to his daughter in Canada. By the time the payment finally landed, she’d already received reminder emails from her school. That’s stressful and exhausting. And for a lot of Nigerian parents, it’s a reality.

But it doesn’t have to be. That’s why so many families are now turning to Myaza. It’s simpler, faster, and far more reliable. And it was built for exactly these kinds of moments.

Here’s why more parents are switching:

1. Sending money without the hidden costs

Banks and traditional transfer services love their fees. They’ll take a cut here, charge an exchange rate there, and by the time your child receives the money, it’s a fraction of what you actually sent.

With Myaza, you don’t have to play that game. Transfers move quickly, exchange rates are transparent, and you always know what’s being deducted. No double charges. No middlemen taking a bite. Just money moving the way you intended.

2. Reliable cards that actually work abroad

For most students, a lot of everyday needs depend on having a working card. Groceries. Subscriptions. Online learning tools. Even a ride back home from class. But anyone who has sent money through a bank knows how often those cards fail when they’re needed most.

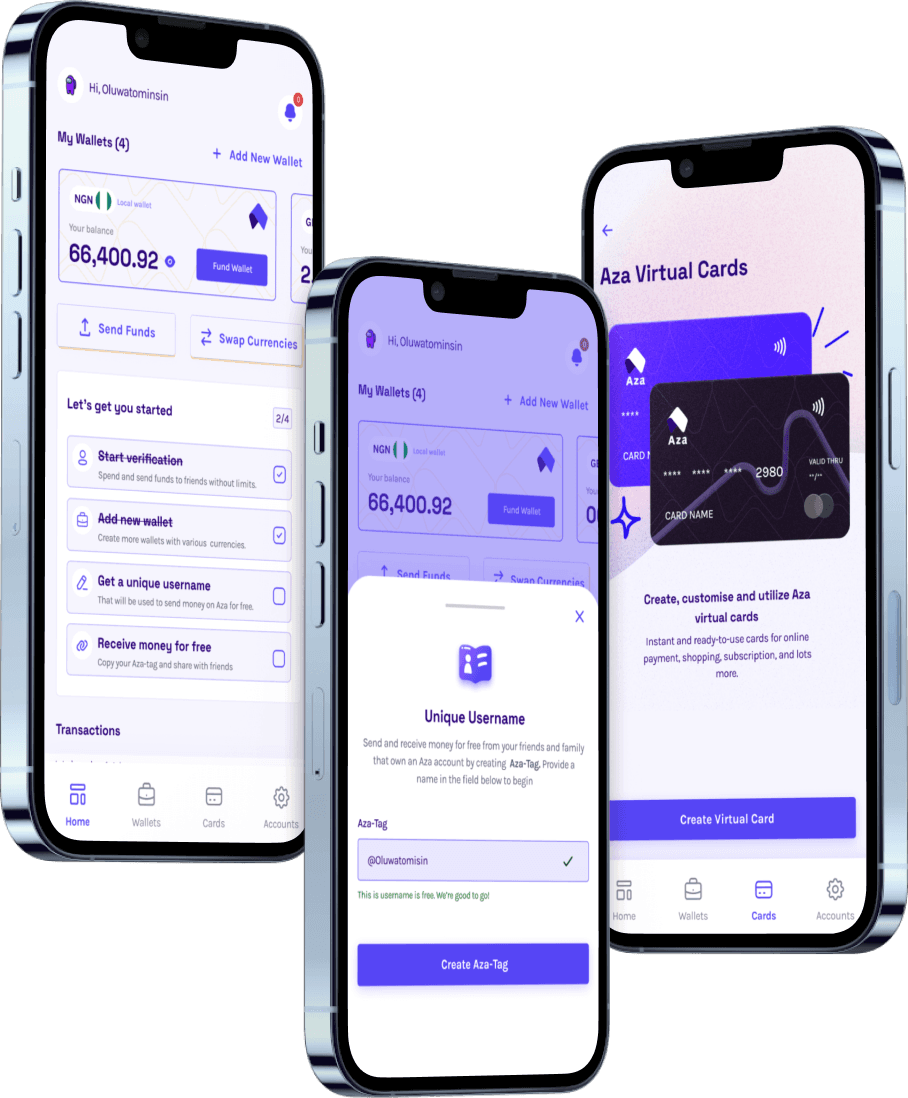

That’s why Myaza gives parents the option to set up a virtual USD card in minutes. Fund it directly from home, and your child can use it abroad with ease. If anything goes wrong, a new card can be created instantly. No panic, no waiting weeks for a replacement to arrive.

3. No more waiting games

Ask a bank how long it takes to send money overseas, and you’ll usually get a range that starts at three days and sometimes stretches into weeks. For school fees or urgent expenses, that’s simply not good enough.

With Myaza, transfers happen instantly. You’ll know when the money has left your account, and your child will know the exact moment it arrives. No refreshing email inboxes. No guessing. Just clarity and speed.

4. Making allowances easier to manage

Some parents prefer sending a monthly allowance. Others do it quarterly, or even once per semester. Whichever way you choose, Myaza makes it easy to plan. You can see what you’ve sent, keep track of conversions, and time your transfers when the rates make the most sense.

It means your child doesn’t have to call home in a panic when rent is due or when their balance suddenly runs dry. The flow of money becomes predictable, and that predictability builds peace of mind for everyone.

5. No paperwork, no surprises

One of the biggest frustrations with traditional banks is the mountain of documents they often demand. Admission letters. Invoices. Receipts. Sometimes even more paperwork than the school itself required.

Myaza cuts through that noise. You don’t need to shuffle files just to send money to your child. You log in, you transfer, and it’s done. They receive it directly in their wallet, and from there, they can either spend with a card, convert to the currency they need, or move funds into their local bank account abroad.

It’s simple, it’s digital, and it actually works.

The bottom line

Sending money to your children abroad shouldn’t feel like a gamble. They depend on you for school fees, for groceries, for housing, for peace of mind.

Myaza makes sure that support gets to them in the fastest, safest, and simplest way possible. No queues. No hidden charges. No endless waiting.

Because at the end of the day, your job is to raise them, guide them, and support them. Our job is to make sure the money part doesn’t get in the way.

Focus on them. We’ll handle the rest.