How to Complete Your KYC Verification and Create a Myaza Card Effortlessly

In today’s digital age, financial tools like virtual cards have become essential for seamless online transactions. With Myaza, the process of creating a card is straightforward—but first, you’ll need to complete your KYC (Know Your Customer) verification. This ensures security, regulatory compliance, and a smoother experience for users.

Whether you’re a seasoned Myaza user or just getting started, this comprehensive guide will walk you through everything you need to know about completing your KYC verification and creating your Myaza card.

Why KYC Verification Is Essential

KYC verification isn’t just a requirement; it’s a safeguard for both you and Myaza. Here’s why:

Enhanced Security: It ensures that only verified individuals can use the platform, protecting your funds and personal data.

Regulatory Compliance: Myaza complies with global financial regulations to prevent fraud, money laundering, and other illegal activities.

Access to Features: Completing KYC unlocks full access to Myaza’s features, including creating virtual cards and conducting transactions smoothly.

Step 1: Completing Your KYC Verification

To get started on Myaza, completing your KYC is your first priority. Follow these detailed steps:

1. Download and Set Up the Myaza App

Download the App: Head to the Google Play Store or Apple App Store to download the Myaza app.

Sign Up: Open the app, provide your email address or phone number, and create a secure password. Verify your email or phone number to proceed.

2. Navigate to the KYC Section

Once you’re logged in, locate the “Account Settings” or “Profile” section.

Click on the “KYC Verification” tab to begin the process.

3. Provide Basic Information (Level 1)

For the first level of KYC, you’ll need to fill in some basic details:

Full Name

Date of Birth

Address

Nationality

Submit this information, and you’ll immediately gain access to some basic features on Myaza.

4. Complete Level 2 Verification

To unlock all features, including creating cards, you’ll need to complete Level 2 verification:

Upload Your BVN (Bank Verification Number): Ensure that your BVN matches the name and details provided during sign-up.

Provide an Official ID: Use a government-issued ID such as a passport, driver’s license, or national ID.

Upload a Clear Selfie: Take a selfie following the app’s guidelines to verify your identity.

Proof of Address: Submit a utility bill or bank statement issued in the past three months.

5. Submit and Wait for Approval

Once you’ve uploaded the required documents:

Double-check your submissions for accuracy.

Submit the information and allow 24-48 hours for Myaza to verify your details.

Pro Tip: Ensure your uploaded documents are clear and legible to avoid delays in the verification process.

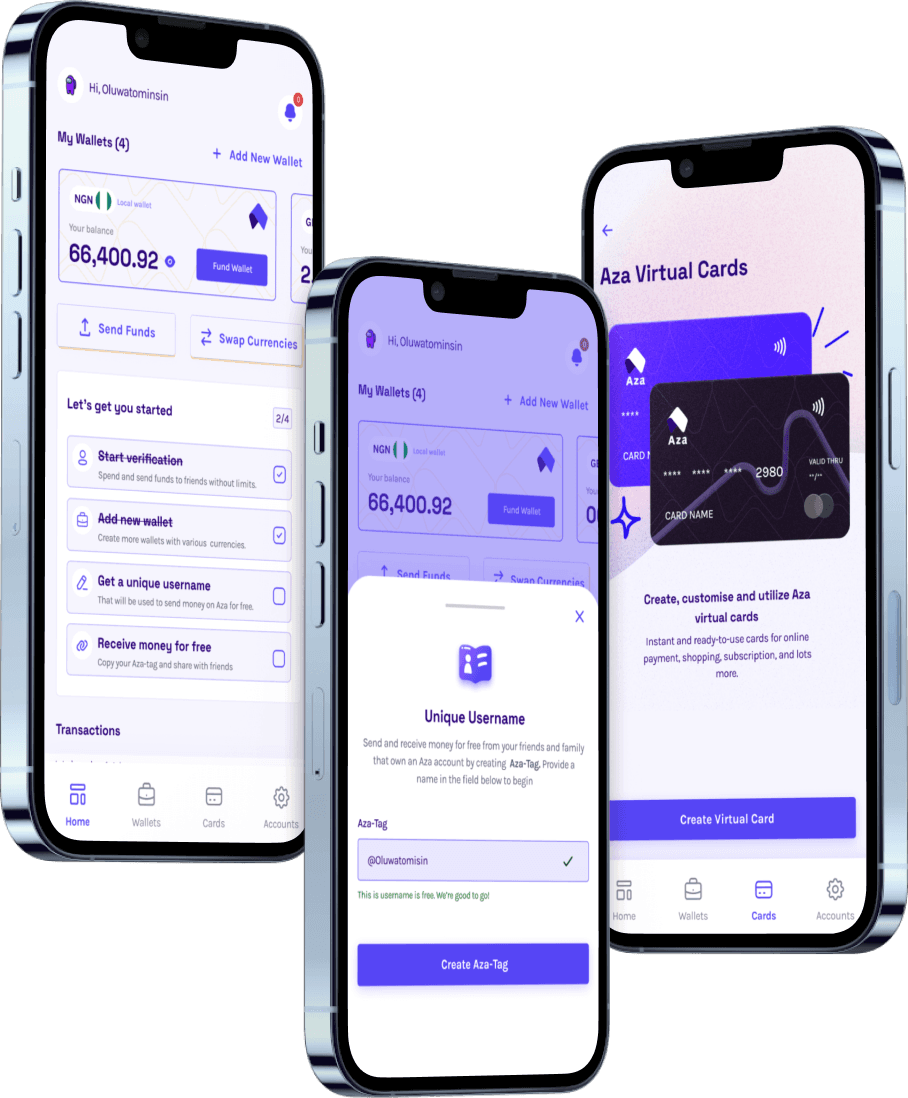

Step 2: Creating Your Myaza Card

After completing KYC, you’re ready to create your Myaza card. Virtual cards are perfect for online shopping, subscription services, and international payments.

1. Access the Virtual Card Section

Log in to your Myaza account and navigate to the “Cards” section.

Click on “Create Card” to begin the process.

2. Choose Your Card Type

Mastercard: Myaza offers Mastercard virtual cards, available in multiple colors for personalization.

Currency Option: Select your preferred currency for the card, such as USD, EUR, or GBP, based on your needs.

3. Fund Your Wallet

Before you can create a card, you’ll need to fund your wallet:

Tap on “Fund Wallet” in the app.

Select Payment Method: Choose options like bank transfer, debit card, or cryptocurrency (e.g., USDT, USDC).

Follow the Instructions: Transfer the desired amount into your wallet. The funds will reflect in your wallet balance shortly.

4. Set Up Your Card Details

Card Name: Give your card a unique name for easy identification.

Spending Limit: Set a spending limit for added control over your finances.

Card Billing Address: Use the Panama billing address provided below for international transactions.

Address: Calle 74 Este, San Francisco

City: Ciudad de Panama

State: Panama

Zip Code: 0401

Phone: 5078338148

5. Activate Your Card

Once the card is created:

Review the Card Details: Your virtual card number, CVV, and expiry date will appear in the app.

Activate the Card: Follow the app’s prompts to activate your card.

Pro Tip: Use a secure password and enable two-factor authentication (2FA) to protect your account and card details.

Tips for a Smooth KYC and Card Creation Process

Keep Documents Ready: Having your ID, BVN, and proof of address handy makes the process faster.

Ensure Matching Details: All information should match the details on your ID and BVN to avoid rejections.

Stay Updated: Turn on notifications to receive updates about your KYC status and card creation.

Common Questions About KYC and Cards on Myaza

Q: Why is my KYC verification taking longer than expected? A: Ensure your documents are clear and match the provided details. Delays can also occur due to high application volumes.

Q: Can I create multiple cards on Myaza? A: Yes! Myaza allows users to create multiple virtual cards, making it convenient for budgeting and managing expenses.

Q: What happens if my KYC verification is rejected? A: Review the rejection reason in the app, make the necessary corrections, and resubmit your application.

Enjoy Seamless Transactions with Myaza

Completing your KYC and creating a card on Myaza opens up a world of possibilities for secure and convenient online transactions. From managing subscriptions to shopping globally, Myaza’s virtual cards are designed to meet all your financial needs.

Ready to get started? Log in to your Myaza app today and enjoy the freedom of secure, borderless payments.