Why Diversifying Your Wallets Matters Just as Much as Diversifying Your Investments

We all know the line: “Don’t put all your eggs in one basket.” It’s practically the opening scene of every personal finance conversation. We apply it to stocks, crypto, and real estate. But here’s something I rarely hear people talk about, especially in Nigeria: diversifying where you actually keep your money.

Because sometimes, the bigger risk isn’t in what you invest in. It's where your money sits quietly, waiting for a problem.

The Wake-Up Call

A few years back, my friend Niyi landed a sweet freelance gig with a UK client. $500 for a logo and brand guide. Small job, big payout. The money hit his domiciliary account here in Nigeria. But when he went to withdraw? The bank said, “No dollars available. Check back next week.”

That “next week” never came in time. He missed a deadline because he couldn’t renew a design tool subscription. That meant he couldn’t deliver the project on time. Which meant… no referral, no repeat work. All that momentum just fizzled.

And this wasn’t a skill issue. It was an access issue. One that’s still happening to people every day.

The Quiet Risk Nobody Talks About

Keeping all your funds in one currency or one bank account feels easy. But it’s a bit like driving without a spare tire: fine until the moment it’s not.

What if your naira card suddenly stops working on an international site? What if your bank quietly blocks foreign transactions for “security reasons”? What if the exchange rate takes a nosedive overnight and your ₦50k feels like ₦35k by morning?

That’s the bottleneck. Not flashy. Not dramatic. Just a slow squeeze on your ability to act when you need to.

Even if you’re not buying stocks or flipping crypto, you’re already in the global economy. Netflix is in dollars. The phone you’re reading this on? Paid for in dollars. Many of your work tools, education platforms, and music subscriptions are priced in currencies our banks don’t always make easy to access.

So why operate like you live in a one-currency bubble?

Diversification Isn’t for “The Rich”

A lot of people hear “diversify” and picture someone with offshore accounts and an accountant named Charles. But it’s really just about having access to more than one currency, especially the ones you actually spend in.

The payoff?

You sidestep sudden currency losses.

You avoid those embarrassing “card declined” moments.

You stay ready instead of scrambling.

Whether you’re a student trying to pay for Coursera, a freelancer buying a domain name, or a 9-to-5 worker renewing Spotify, it matters.

How to Start Without Overcomplicating It

You don’t need five different banks or a finance degree.

Look at Your Spending by Currency

Check your last month’s expenses. How much went to naira-based costs and how much to dollar-based ones? Even $30 a month on Canva, Apple Music, or Udemy is a sign.

Split Your Funds Intentionally

Maybe you keep 80 percent in naira for local spending and 20 percent in USD for online payments and savings. You can tweak it based on your life.

Use Tools That Make Currency Switching Easy

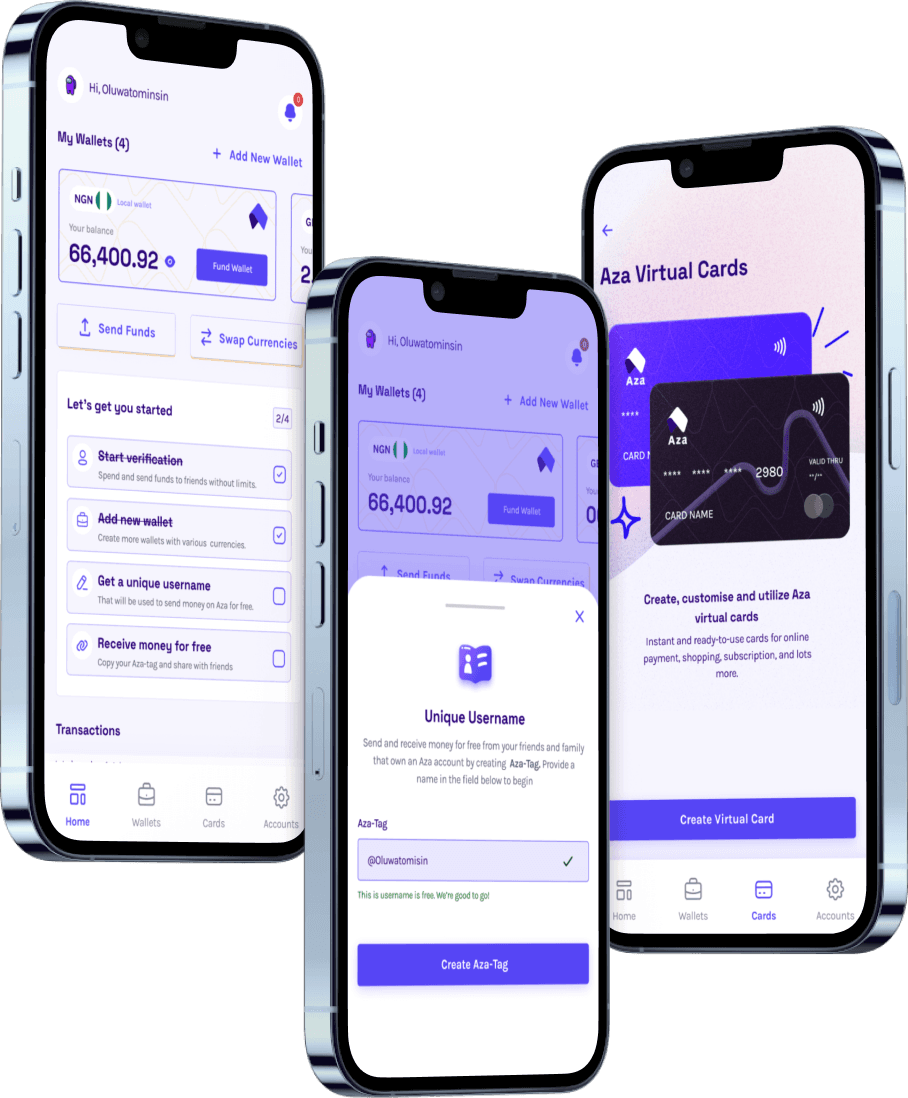

Myaza lets you:

Hold multiple wallets (Naira and USD)

Create a virtual dollar card for online payments

Convert currencies in-app without drama or queues

What It Looks Like in Real Life

Tolu, a creative director, skipped the FX black-market hustle by keeping $100 in her Myaza USD wallet. When her bank card failed, she paid for her design plugins instantly.

Emeka, a dad, paid his son’s UK school application fees without calling anyone or standing in a bank hall.

Chika, who runs an online store, gets paid in dollars and uses the same wallet to cover Shopify, Facebook Ads, and Zoom. No third-party workarounds.

These aren’t “finance case studies.” They’re just regular Nigerians who decided not to gamble their work on bank whims.

Let’s Be Honest

The Nigerian banking system wasn’t built for a fully digital, globally connected lifestyle. It’s catching up slowly. But until it does, you have to create your own workarounds.

You don’t need to fight your bank to pay for Netflix. You just need to stop depending on a single point of failure.

The Myaza Way

At Myaza, we believe having smooth access to your money shouldn’t be a privilege. We built a platform where you can:

Save in multiple currencies

Shop globally without stress

Get paid from anywhere, easily

Because your money shouldn’t feel trapped.

Diversify your wallets. Give yourself options. Open a USD wallet on Myaza, link it to your virtual card, load it up, and use it when you need it.

The future isn’t just local. Your wallet shouldn’t be either.